Sunday, April 20, 2025

Josh Cable

If your business has SaaS subscriptions – and these days, it’s hard to find one that doesn’t – you might have noticed something curious on your invoice.

Sales tax. It could be a few dollars. It could be a lot more than you’d expect. And in some cases, it seems to appear out of thin air – after months (or years) of not being charged at all.

What gives? Welcome to the world of SaaS tax: a puzzling patchwork of state and local laws, shifting definitions, and unpredictable billing practices that impact every company paying for software as a service.

As SaaS adoption soars, more and more business users are asking a simple question: Is SaaS subject to sales tax? While the question is straightforward, the answer isn’t.

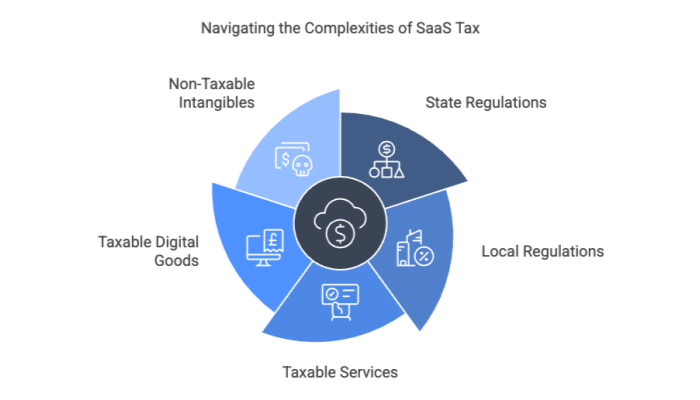

Unlike perpetual‑license software that’s downloaded or installed on‑premises, SaaS is delivered over the internet, which makes its taxability more nuanced. Some states treat it like a digital product. Others see it as a taxable service. A few consider it tangible personal property. And some don’t tax it at all – for now.

Even if you’re not in finance or procurement, understanding how your SaaS tools are taxed can help your team budget smarter and avoid compliance headaches down the road.

At its core, SaaS tax refers to sales or use taxes charged on software‑as‑a‑service tools – depending on where your business is located and whether your vendor is required to collect sales tax in that state.

If only it were that simple.

Most sales‑tax laws originally were written for tangible goods – physical products such as furniture, appliances, cars, and clothing. To adapt them to cloud‑based software, states (and some municipalities) have had to reinterpret those rules.

The result? A hodgepodge of disjointed regulations that treat SaaS as a taxable service, a taxable digital good, or a non‑taxable intangible – depending entirely on the state.

New York and Texas tax software as a service. Other states, such as Florida and California, generally don’t tax SaaS at all. And then there are states with special conditions – for example, only taxing SaaS when it’s downloaded or bundled with tangible items.

And just when you think you have it figured out, along comes the local wildcard. You could be doing business in a state that doesn’t tax SaaS at all, but individual cities or counties within that state do. For example, Illinois doesn’t tax SaaS statewide, but Chicago does. These local rules can catch businesses off guard if they’re only looking at the state level.

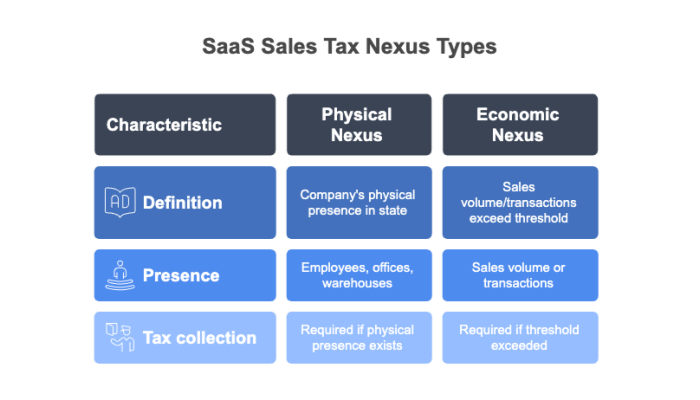

Whether or not your SaaS provider charges you sales tax depends on a concept known as “nexus.”

In layman’s terms, nexus means the provider has enough of a business presence in your state that it’s legally required to collect and remit sales tax.

There are two main types of nexus:

If a SaaS vendor doesn’t have nexus, it usually won’t charge tax, even if your state technically taxes SaaS. This is one reason why the same product could show a tax on one company’s invoice and not on another’s.

Thanks to the 2018 South Dakota v. Wayfair Supreme Court ruling, U.S. states now have the power to enforce economic nexus laws – which means many SaaS providers are required to collect tax in far more places than before.

Download our free e-book, “The SaaS Tax: How Subscription Software Is Draining Your Profits Every Month” and learn how to identify and minimize the hidden SaaS taxes that quietly drain your profits. Get practical tips for reducing SaaS expenses without sacrificing functionality. Download your free copy today!

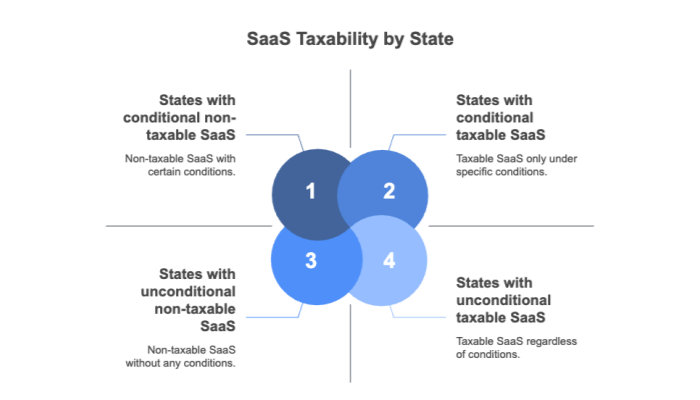

When it comes to taxing software as a service, states don’t exactly see eye to eye. How states classify SaaS taxability typically falls into one of three buckets: Taxable, Non‑Taxable, or It’s Complicated (Conditional).

Here’s an overview of how different states approach SaaS taxability:

The bottom line? SaaS taxability is far from consistent – and it’s still evolving.

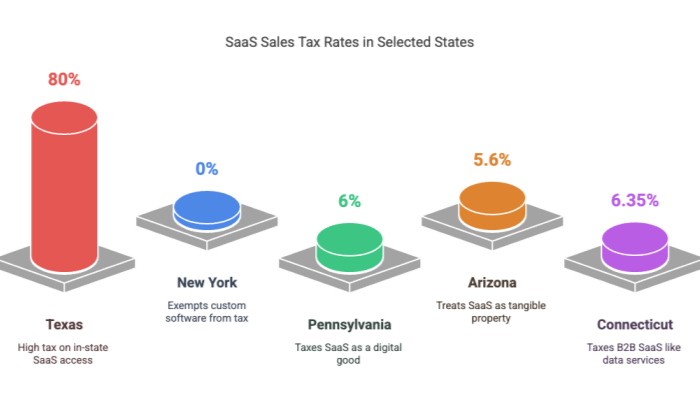

According to Stripe, 32 states impose some form of SaaS software sales tax, depending on specific conditions such as the method of delivery and the nature of the service provided. A few notable examples include:

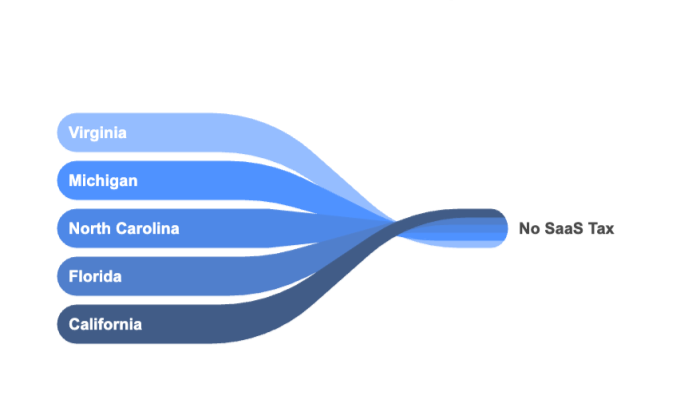

On the other end of the spectrum, states that currently don’t tax SaaS include:

One thing to keep in mind: Tax laws change. Several of these states have explored expanding their tax base to include digital services, so the “no‑tax” window could close over time.

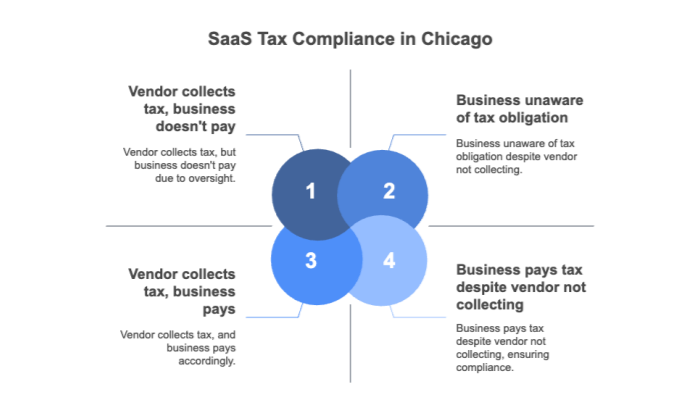

Even if your state doesn’t tax SaaS, some local governments do. A prime example: Chicago.

Under the city’s Personal Property Lease Transaction Tax, Chicago-based businesses owe tax on nonpossessory computer leases, including many SaaS tools used to input, modify, or retrieve their own data.

As of Jan. 1, 2025, the rate is 11%, and it applies regardless of whether the vendor collects it. If your team uses cloud-based software within city limits, you could be on the hook for local taxes – even if your invoice doesn’t show it.

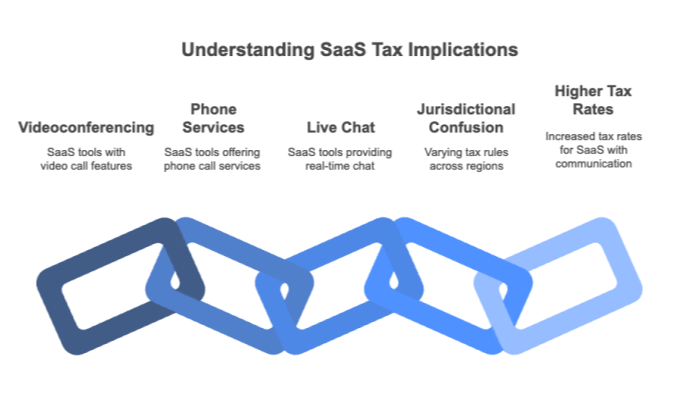

Some jurisdictions make things even more confusing by applying telecom taxes to SaaS tools that include communication features.

If your SaaS product includes videoconferencing, phone services, or live chat, it might be subject to telecommunications taxes – a separate (and often higher) category of tax.

Download our free e-book,“ The SaaS Tax: How Subscription Software Is Draining Your Profits Every Month” and learn how to establish a basic auditing framework for your organization. A strong auditing process can help you identify redundancies and uncover cost-saving opportunities. Download your free e-book today!

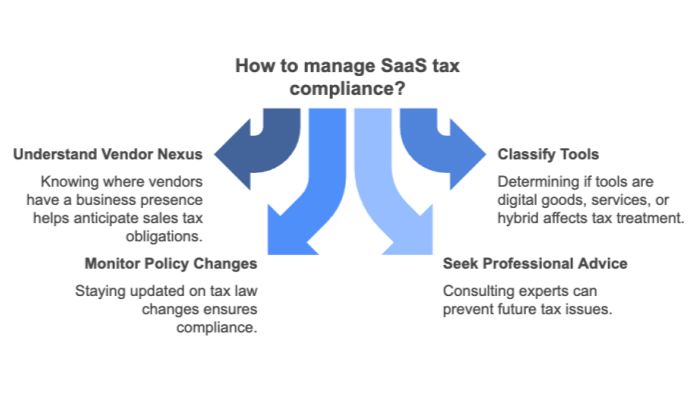

SaaS tax compliance might feel like it’s out of your control, but there are proactive steps you can take to stay on top of your tax obligations.

While SaaS tax might not be the most exciting line item on your invoice, understanding it can help your business stay compliant, avoid unexpected costs, and even gain negotiating leverage with vendors.

But there’s another type of SaaS tax to be aware of, and you won’t find it codified in any statutes or regulations. Costs and fees that are above and beyond the advertised price of a SaaS platform are essentially a tax on your business – and you probably don’t even realize you’re paying it.

Unlike taxes in the traditional sense, these taxes exist solely for the purpose of enriching SaaS vendors at your expense.

State-level sales tax on SaaS might be an unavoidable cost of doing business, but obfuscated fees, automatic upgrades, and hair-trigger overages are the kind of SaaS taxes that shouldn’t be.

By shifting to Smart SaaS™ providers that prioritize clear pricing and fair contracts, business users can bypass the unexpected SaaS fees that tax their budgets and patience.

Smart SaaS™ is the tax reform businesses have been waiting for.

Explore our library of SaaS resources for smarter software strategies, and download “The SaaS Tax: How Subscription Software Is Draining Your Profits Every Month” for a SaaS tax survival guide – and more. Take control of your SaaS strategy today!

Unlike perpetual‑license software that’s downloaded or installed onsite, SaaS is a subscription service that’s delivered via the internet – which makes its taxability status complicated. In this FAQ, we answer common questions about SaaS sales tax and SaaS tax compliance.

No, SaaS isn’t subject to sales tax in every state. Some states tax SaaS as a service or digital good, while others don’t tax it at all. A few impose tax only under certain conditions. Taxability depends on where the buyer is located and whether the vendor has nexus – a legal connection to the buyer’s state.

As of now, more than 30 states tax SaaS in some form, including New York, Texas, and Pennsylvania. Rules vary. Some states tax all SaaS, while others apply tax only to off‑the‑shelf solutions or when SaaS includes downloadable components. Some local jurisdictions (e.g., the city of Chicago) impose SaaS‑related taxes, even if there isn’t a statewide SaaS sales tax.

Most companies rely on tax software or third‑party providers to handle SaaS tax compliance. These tools track jurisdiction-specific rules, calculate applicable taxes, and automate filing. For multi‑state operations, it’s smart to consult with a tax advisor who understands nexus, SaaS classifications, and evolving sales‑tax laws to avoid penalties or overpayment.

SaaS sales tax applies to software delivered over the internet, depending on local tax laws. Telecom tax, however, targets communication services such as VoIP, videoconferencing, or chat features. If a SaaS product includes telecom functions, it may trigger both types of taxes, often at higher rates and with more complex compliance requirements.