Wednesday, April 16, 2025

Kevin Anderson

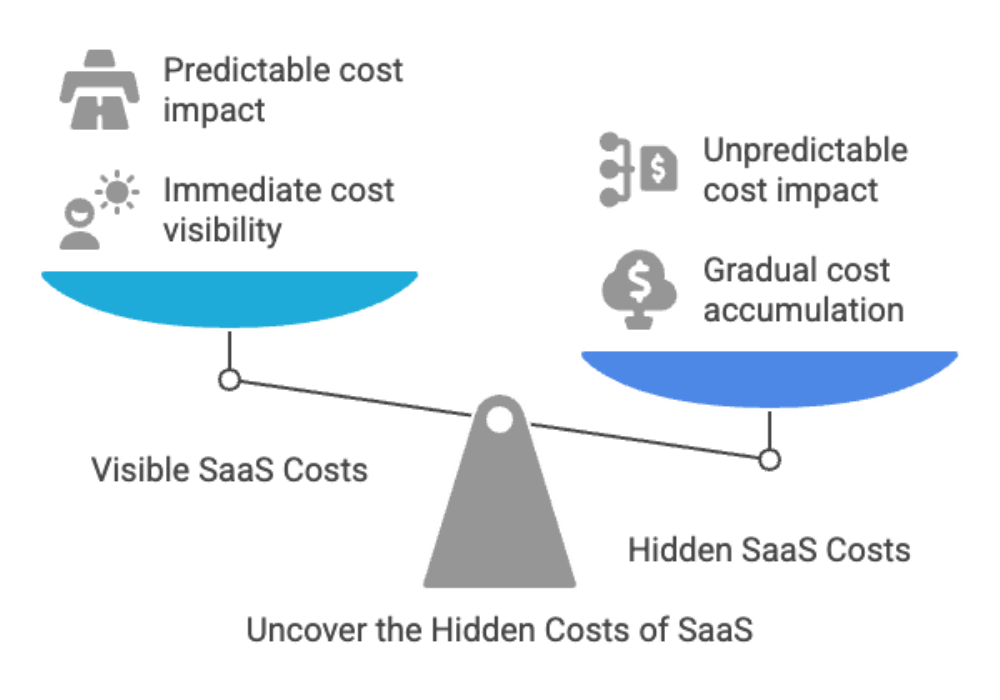

In theory, SaaS should be a company’s best friend. It’s scalable, accessible, and cost-effective—until it’s not. What many organizations discover, far too late, is that their beloved stack of tools has quietly evolved into a tax system. Not one designed by governments, but by vendors. And instead of supporting growth, it drains profit. This hidden cost is what we call the SaaS Tax—a collection of fees, pricing tricks, and fine-print traps that quietly inflate your spend, sap your margins, and keep your business hooked on overpriced software.

On paper, your SaaS contract might look clean. It might promise "$49/user/month" or "pay-as-you-scale" freedom. But that headline number is rarely what you actually pay.

The reality is more complex—and more expensive. Behind every simple subscription is a mix of usage-based escalators, feature-gated tiers, integration surcharges, auto-renewal clauses, and price bumps hidden in vague language. In many cases, the hidden fees become an intrinsic part of the SaaS business model that companies adopt without realizing the full cost implications.

According to Zylo, companies underestimate their SaaS spend by more than 300%. That’s not just a line item oversight—it’s a systemic failure to manage what’s become one of the largest expense categories in modern business.

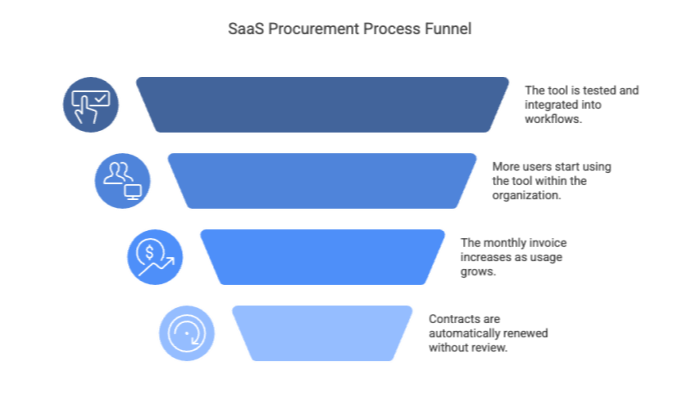

Traditional SaaS buying models are fundamentally flawed; many organizations approach software procurement as if they were simply ordering office supplies. Someone discovers a tool through a free trial, and before long, it becomes embedded in the workflow—spreading organically without structured oversight.

This decentralized buying behavior, coupled with vague pricing models and feature-based upsells, leaves companies at the mercy of vendors who’ve designed their pricing structures primarily for revenue extraction.

Licenses go unused. Features go undiscovered. And contracts get auto-renewed with terms no one remembers negotiating.

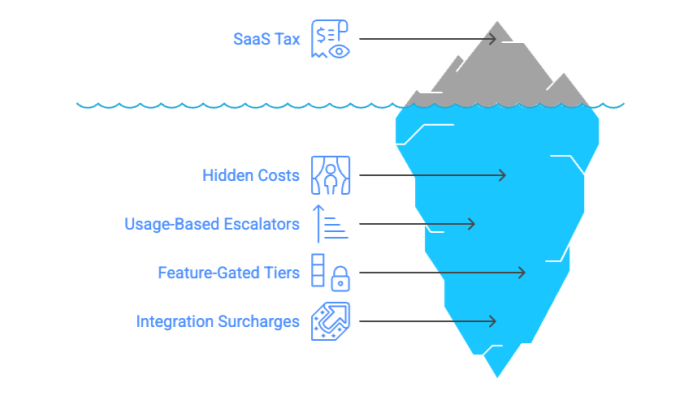

Think of the SaaS tax like an iceberg. The license fee you see is just the visible tip. Below the surface, a much larger mass of invisible costs awaits.

Storage overages, API call thresholds, premium support tiers, and integration charges are designed to seem minor or ignorable until they eventually accumulate. By the time these fees become evident, they have become deeply embedded within your operations, making them difficult to remove.

Even worse, as your team expands or your revenue increases, the pricing structure inflates—not as a reflection of growing value but as a mechanism for vendors to extract a larger slice of your success. This phenomenon is reminiscent of the strategic distinctions discussed in vertical versus horizontal SaaS, where scaling challenges are often masked by upfront simplicity.

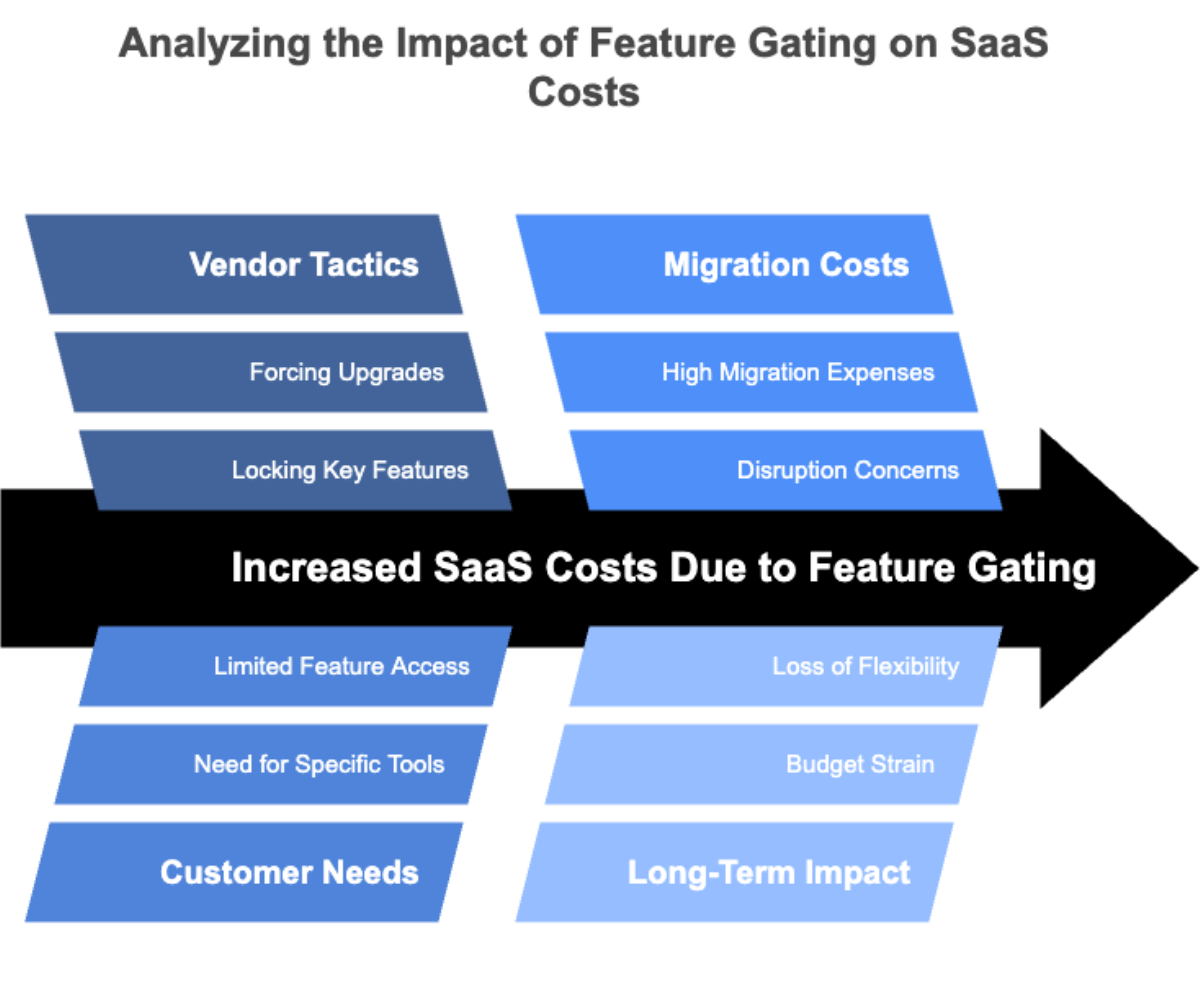

Another tactic that fuels the SaaS tax is feature gating—often referred to as the functionality tax. Vendors intentionally lock key tools, such as reporting, integrations, or even advanced security, behind higher-tier plans.

The result is that companies are coerced into upgrading to a more expensive package even when they only need a single critical feature.

This is akin to having to purchase an expensive luxury vehicle just to activate standard features like air conditioning. The inconvenience of switching vendors or reconfiguring systems makes these additional costs feel inevitable.

Over time, these incremental expenses accumulate, not only straining budgets but also reducing operational flexibility and autonomy.

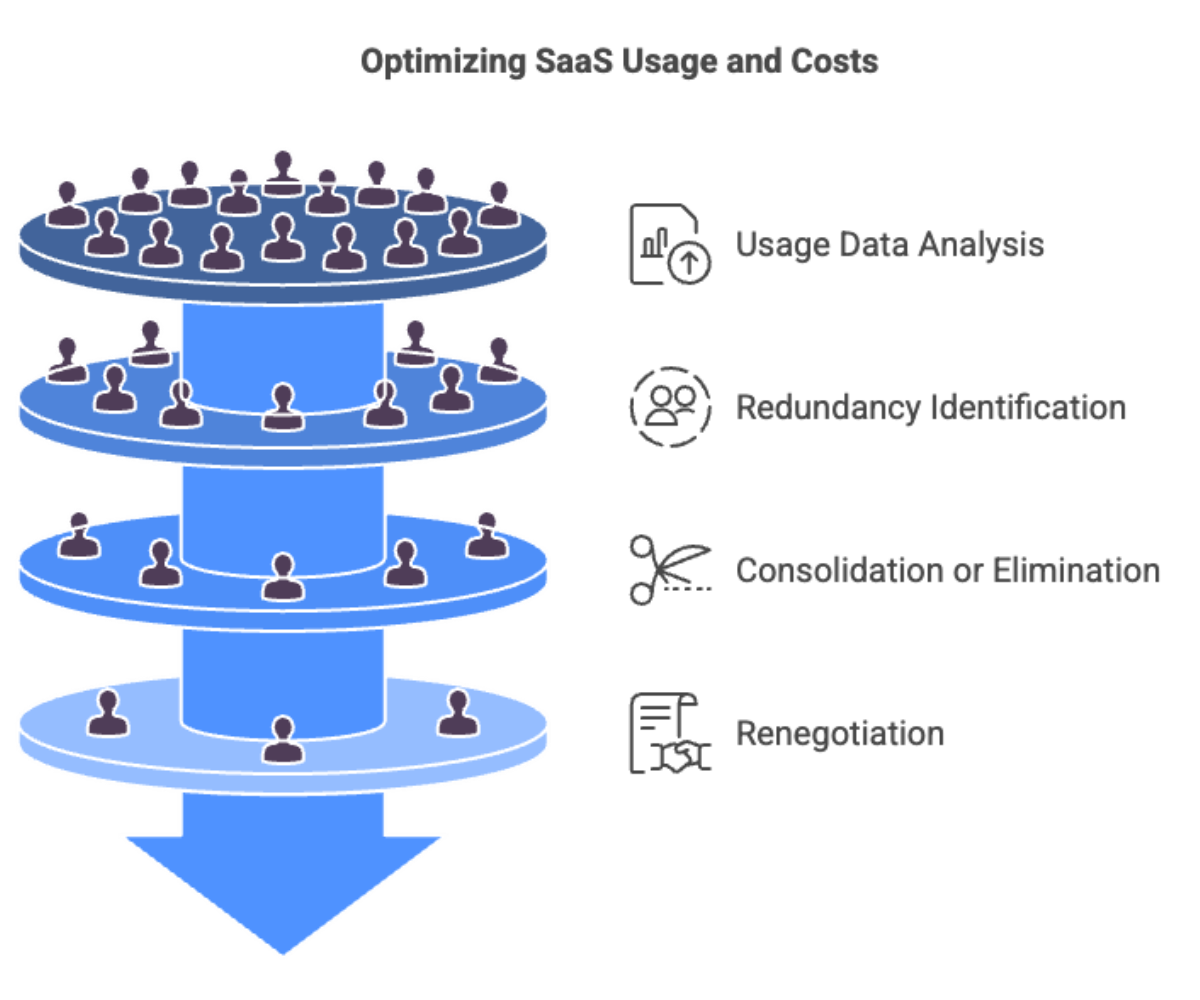

The first step to dismantling the SaaS tax is gaining clear visibility into what you’re paying for and understanding whether it delivers true value. This calls for comprehensive audits that examine not only invoices but also usage data and potential redundancies across your stack. In fact, performing regular deep audits aligns with practices highlighted in SaaS management platforms.

Start by evaluating your most expensive or widely used tools. Verify whether all user licenses are active, if key features are fully leveraged, and if overlapping tools could be consolidated.

If you identify areas of overlap or underuse, it’s time to consolidate, renegotiate, or eliminate those subscriptions. Building a process around regular SaaS audits—integrated into quarterly budget reviews and contract renewals—is crucial for long-term savings.

Once you’ve identified the inefficiencies in your existing software stack, it’s time to establish a more disciplined procurement framework—one that values clarity and long-term scalability over quick fixes. Consider integrating insights from enterprise SaaS pricing models to guide your negotiations and ensure sustainable growth.

The answers to these questions should drive both your vendor selection and contract negotiations. A strategic approach not only curbs unnecessary expenses but also sets a solid foundation for scalable operations.

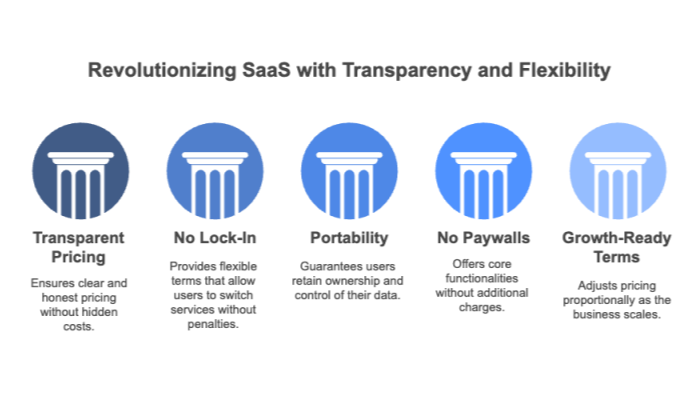

In contrast to the bloated and manipulative fee structures prevalent in the industry, the Smart SaaS™ approach offers a refreshing alternative. It is built on five core principles:

This mindset echoes innovative solutions discussed in Smart SaaS Applications that are revolutionizing industries by prioritizing customer value over complex fee structures.

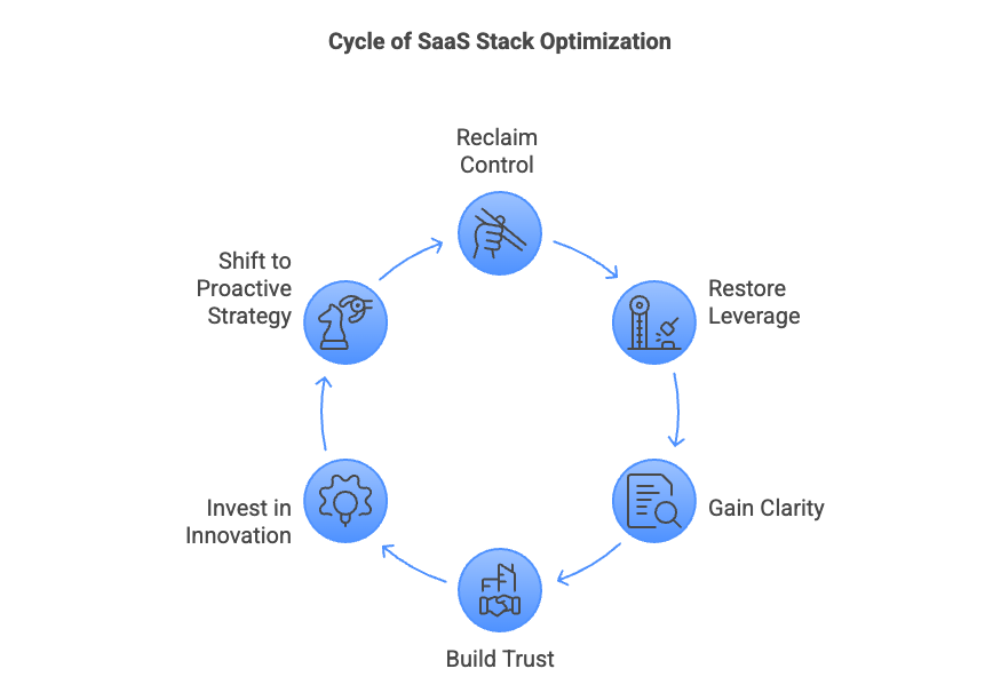

Reclaiming control of your SaaS stack isn’t merely a cost-saving measure—it restores leverage, clarity, and trust across your organization. It empowers you to redirect funds into innovation rather than maintenance, shifting from reactive software consumption to proactive strategy. In fact, many of the best practices in SaaS data security emphasize reclaiming control as a key to sustainable growth.

Every platform in your stack should serve your business goals—not the other way around. If a particular tool fails to deliver value, it’s time to renegotiate or even replace it.

By implementing a rigorous review process and encouraging cross-departmental collaboration, you can ensure that every subscription contributes meaningfully to your objectives. Establishing clear performance metrics and regular audits will help maintain a lean, agile software environment that grows with your business.

Software will always be part of the modern business equation. But how we pay for it, how we manage it, and how we control it? That’s where the reset is overdue.

Don’t normalize tier creep, upgrade fatigue, or “surprise” renewals. Question every assumption. Interrogate every feature. Challenge every contract.